ADVANCE TAX CALCULATION

Explore all about Advance Tax: Discover Due Dates, Calculators, Applicability, Procedure, and Installment Details in this comprehensive guide.

What is Advance Tax?

Advance tax is the income tax that is paid in advance instead of lump sum payment at year end. It is the tax that you pay as you earn.These payments have to be made in instalments as per due dates provided by the income tax department.

Who Should Pay Advance Tax?

Advance tax is applicable to all taxpayers, including salaried individuals, freelancers, and businesses, if their total tax liability exceeds Rs 10,000 in a financial year. However, senior citizens aged 60 years or older, who do not engage in business, are exempt from advance tax payment.

For businesses opting for the presumptive taxation scheme under section 44AD, the entire advance tax amount is due in one installment by March 15th, with an alternative option to pay by March 31st. Similarly, independent professionals like doctors, lawyers, and architects, operating under the presumptive scheme under section 44ADA, must pay their entire advance tax liability in one installment by March 15th, with the possibility of payment by March 31st.

Advance Tax Due Dates For FY 2023-24

Ensure timely payment of advance tax with the following schedule:

– By June 15th: Pay 15% of the advance tax.

– By September 15th: Pay 45% of the advance tax, deducting the amount already paid.

– By December 15th: Pay 75% of the advance tax, subtracting the amount already paid.

– By March 15th: Complete the payment with 100% of the advance tax, deducting any previous payments made.

For taxpayers who have opted for Presumptive Taxation Scheme under sections 44AD & 44ADA – Business Income

Due Date Advance Tax Payment Percentage

On or before 15th March 100% of advance tax

How to Pay Advance Tax Online?

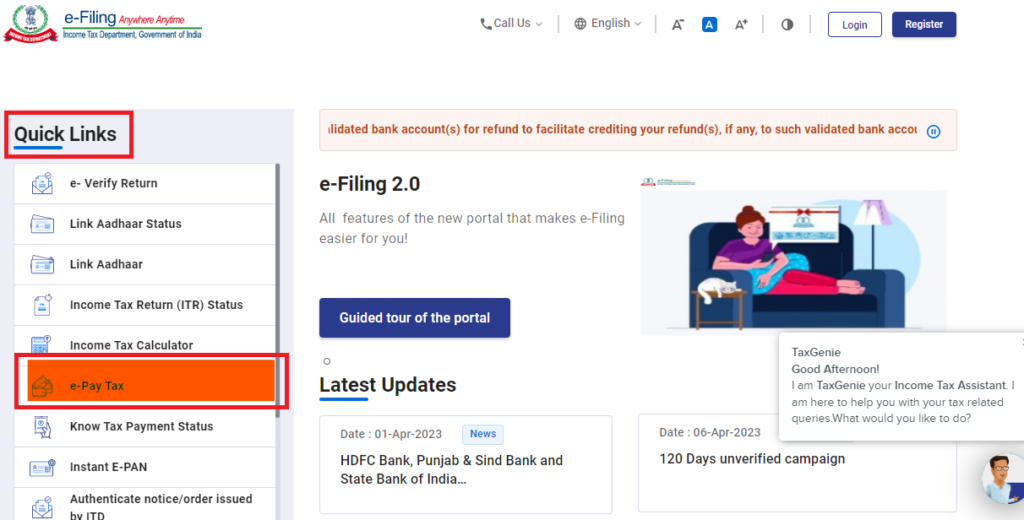

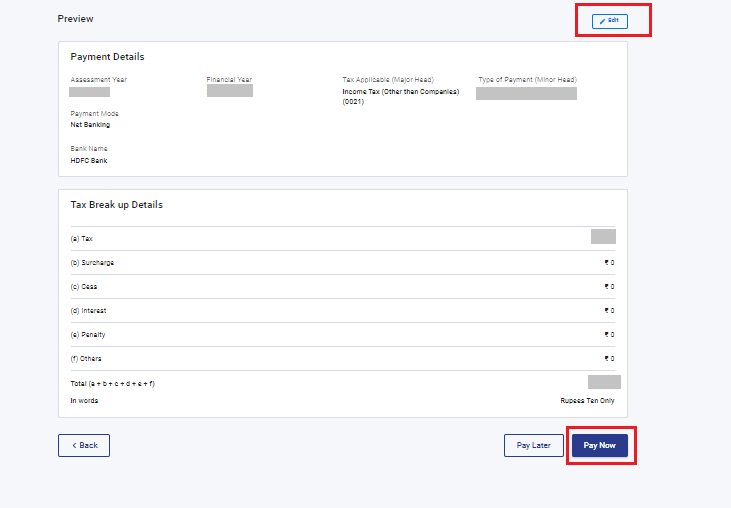

1. Visit the e-filing portal of the Income Tax Department of India

2. On the left side of the home page, there is a ‘Quick Links’ section, click on the ‘e-Pay Tax’ option. You can also search for ‘e-Pay Tax’ in the search bar.

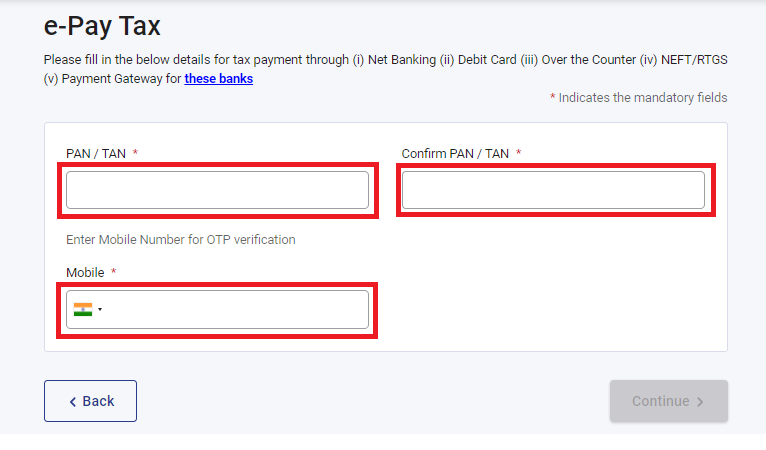

3. On this page, enter your PAN and re-enter to confirm it. Then, enter your mobile number and click on ‘Continue’.

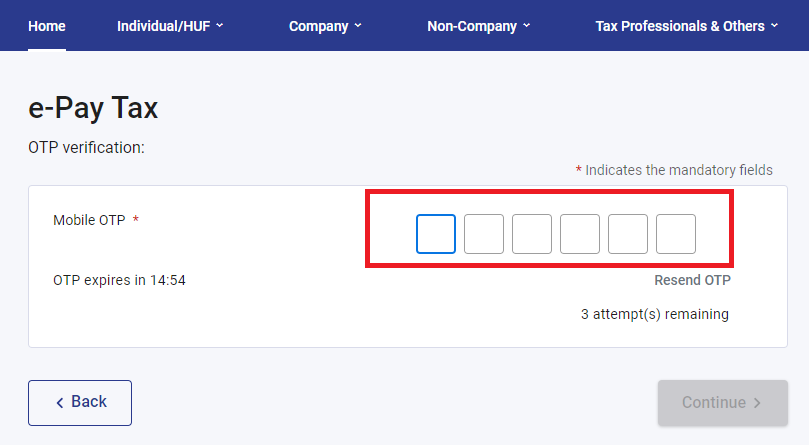

4. Now enter the 6-digit OTP received on your mobile number and ‘Continue’.

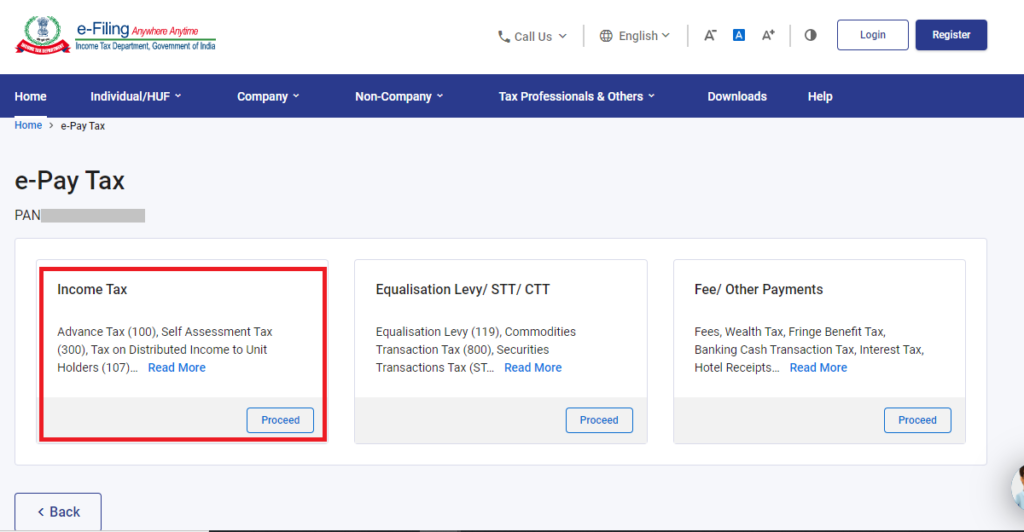

5. Select the first box labelled as ‘Income Tax’ and click on ‘Proceed’

6.Select the ‘Assessment Year’ as 2024-25 and ‘Type of Payment’ as ‘Advance Tax (100)’ and click on ‘Continue’.

Interest on advance tax:

1. Non-payment of advance tax will attract interest under 234B: As per Section 234B, you must pay at least 90% of the total taxes as advance tax by 31st March. Failure to make advance tax payments will result in an interest @ 1% on the unpaid amount.

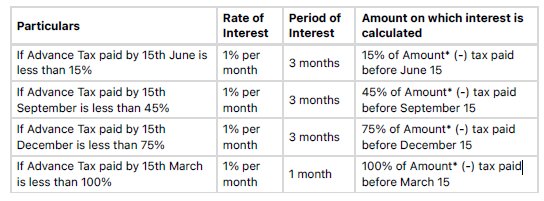

2. Delay in payment of advance tax will attract interest under 234C:

Have Any Questions?

FAQ's related to Dexter Consultancy

When should I pay advance tax?

If your tax liability for a year after reducing TDS exceeds Rs 10,000,

you will be liable for payment of advance tax.

I have made a mistake in Advance tax challan. How can I rectify the mistake made in Advance tax payment?

Made a mistake in your tax payment challan? Do not worry! You can

now correct it easily. The Income Tax Department has recently

launched online challan correction feature, where you can make

changes to:

assessment year,

major head and

minor head [100 (Advance tax), 300 (self-assessment tax), and

400 (demand payment as regular assessment tax)]

Changes to the assessment year must be made within 7 days of

payment and changes to major head and minor head can be made

within 30 days of payment.

Is an NRI liable for payment of advance tax?

An NRI, who has an income accruing in India in excess of Rs 10,000,

is liable for payment of advance tax.

I am a senior citizen with pension and interest income. Should I pay advance tax?

Resident senior citizens not having income from business or

profession are not liable for advance tax.

Will I be penalized if I do not pay advance tax?

Non payment of advance tax will result in levy of interest under 234B

and 234C of the Income tax Act, 1961.

Can I claim deduction under 80C while estimating income for determining my advance tax?

Yes. You can consider all these deductions while estimating your

income for the year for computing your advance tax liability.